Would you talk with someone in our company regarding any issues? Just drop us a line!

Swiss GmbH: A Guide to Registration and Benefits

Opening a Swiss GmbH in 2025 allows you to access a favorable business environment. Switzerland has consistently ranked among the most competitive economies in the world, making it a prime destination for international entrepreneurs.

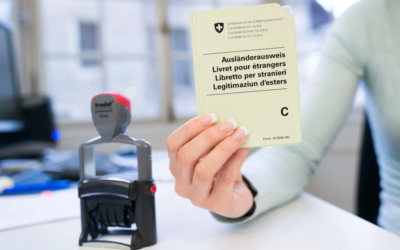

However, before registering a Swiss GmbH (Swiss LLC), it is essential to understand the legal requirements and regional regulations, which may vary by canton. Get professional assistance with your Swiss GmbH formation from our experienced team of specialists.